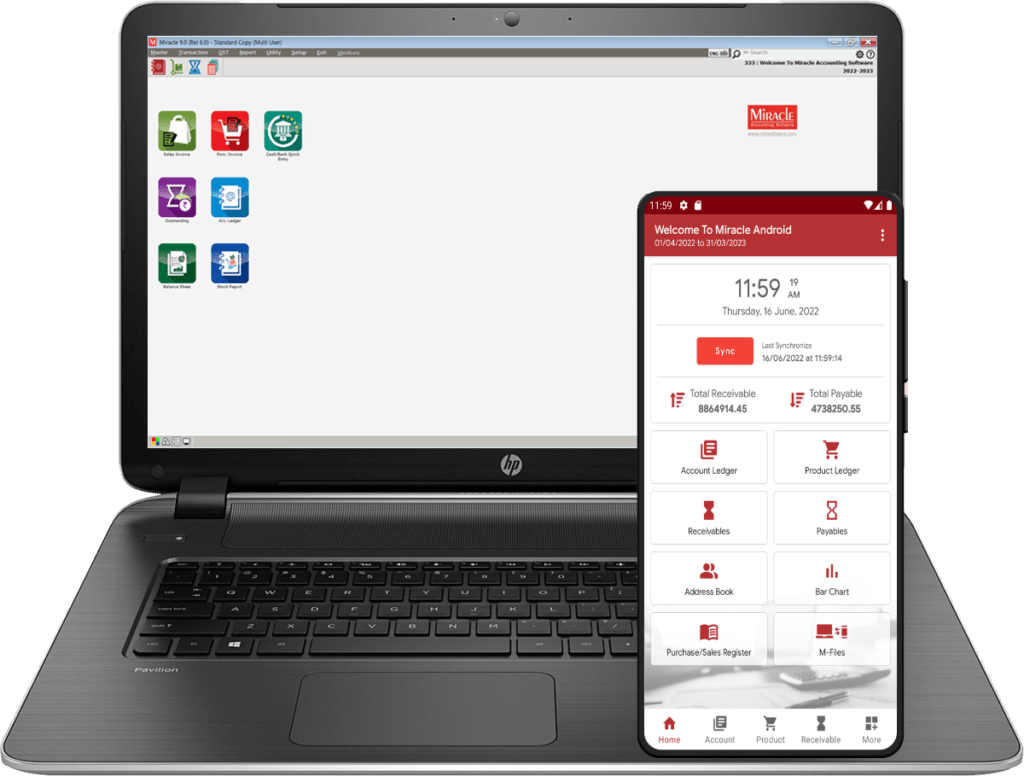

Miracle accounting software is a general-purpose GSTready accounting and billing software. please go through the below facility that has been added to miracle accounting software version 9.0 7.0.

Place of Supply (POS)

The place of supply is where the goods are delivered, so from now user can

change place of supply while adding vouchers in miracle.

Auto PIN to PIN Distance Fetch for E-Way Bill

With Miracle, you no longer need to calculate PIN to PIN distance manually

while creating an E-Way Bill, as Miracle will fetch the distance automatically.

Built-in feature for downloading GSTR 2A & 2B based on GSTIN

From now user can download GSTR2A & GSTR2B directly in Miracle using

GSTIN login.

Track the Status of Your Company’s GST Return*

It is now possible for users to track and check the status of their company’s

GST Return on a timely basis by using the Miracle GST Return status facility.

GSTIN-based Search for party GST number*

User can easily verify all detail with GSTIN record and check status of GST

number given by party.

Check the status of a taxpayer eligibility for an E-Invoice*

User can easily check that whether they need to generate E-invoice or not as

per government.

Facility for verifying GST numbers when filing GSTR1*

Using Miracle, the user can now verify GST number when filling out GSTR1 in

order to prevent inappropriate GST numbers.

JSON Storage Folder for Auto E-Way Bill & Auto E-Invoice

Well-structured storage folders make it easy to locate Auto E-Invoices and

Auto E-Way Bill responses uploaded by users.

Advance Salary facility for TDS

For advance salary, TDS salary to be deducted and adjusted against salary

month on month

3year Agewise Outstanding Report

User can now view the Outstanding Report for the past three years with an

agewise summary.

for more details, you can call us on 9426450998